Kognitos Helps National Logistics Provider Eliminate 98% Of Manual Data Entry Tasks

This customer is a comprehensive logistics service provider offering dedicated and regional truckload services, warehousing, brokerage, and maintenance across the

Kognitos is attending ITC Vegas, October 14-16 in Las Vegas. See us at booth #454 or join us for dinner at Momofuku.

Kognitos enables AI transformation in Banking, Financial Services, and Insurance based on the unique use cases and workflows of the industry.

Kognitos addresses the BFSI industry’s needs with next-generation automation for workflows like procure-to-pay and record-to-report. With Kognitos, your firm can finally look to introduce artificial intelligence to automate beyond simple repetitive tasks and evolve to tackle highly complex processes.

Our mission is to empower enterprise organizations to achieve AI transformation in complex and

repetitive workflows through the deployment of safe and trusted artificial intelligence solutions.

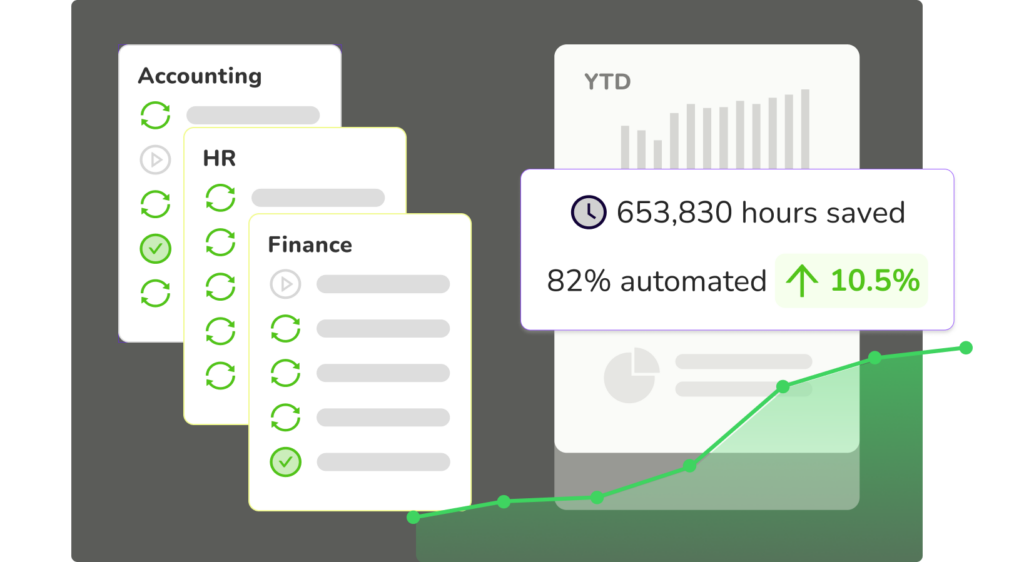

Build robust workflows in hours or days instead of weeks and months

Run processes concurrently and at infinite scale, rapidly increasing productivity across departments

Say goodbye to bots for good with no need to manage UI changes, software licenses, and other hassles

Drastically reduce downtime associated with bugs and breaks in your workflows

This customer is a comprehensive logistics service provider offering dedicated and regional truckload services, warehousing, brokerage, and maintenance across the

Our client, one of the world’s largest Multinational Food and Beverage Companies, with its products sold in 200+ countries, reduced

EOS Group, a leader in the field of receivables management, utilizes its deep-rooted expertise spanning over five decades to offer

Banking automation involves the use of advanced technologies like ai to streamline banking operations such as account management, customer service, and transaction processing. Kognitos enhances these processes by automating routine tasks like data entry and compliance checks, leading to increased efficiency and reduced human error. As a result, banks can provide faster and more accurate services, maintain regulatory compliance effortlessly, and focus on strategic growth opportunities while cutting operational costs.

Kognitos’ financial service automation solutions are designed to optimize processes like transaction monitoring, risk assessment, and reporting through ai-driven technologies. By automating data collection and analysis, financial institutions can ensure compliance with regulatory standards, detect potential fraud, and gain real-time insights into financial performance. This enables faster decision-making and enhances customer service, leading to improved trust and loyalty among clients.

Absolutely. Kognitos specializes in automating finance and accounting tasks, such as ledger management, invoicing, and tax compliance. Our platform uses accounting workflow automation to minimize manual data entry and reconciliation, thereby reducing errors and increasing efficiency. Organizations benefit from faster processing times, more accurate financial reporting, and the ability to focus on strategic financial planning rather than routine paperwork.

Insurance service automation with kognitos enhances policy management and claim processing by using ai to automate routine and complex tasks. Our insurance automation services ensure timely and accurate policy updates, reduce the turnaround time for claims, and improve customer service by automatically triggering communication at different stages. These efficiencies lead to cost savings, enhanced regulatory compliance, and increased customer satisfaction, setting insurers apart in a competitive market.

Automated banking workflows, powered by kognitos, remove bottlenecks in processes like account opening, loan processing, and fraud detection. By automating these workflows, banks can handle high volumes of transactions with speed and precision. The result is improved operational efficiency, reduced risk of errors, and the ability to deliver services quickly to meet customer expectations. This level of automation supports business growth and enhances competitive advantage.

Kognitos offers ai tools tailored for finance and accounting that focus on enhancing real-time data processing, predictive analysis, and decision-support systems. Our platform automates and refines accounting tasks, such as financial forecasting and variance analysis, to provide finance teams with actionable insights. These ai tools not only streamline day-to-day operations but also fortify financial planning and strategy with accurate, data-driven insights.

Kognitos’ ai-driven financial operations provide banks and financial institutions with unparalleled accuracy, speed, and efficiency. By automating routine processes and integrating advanced analytics, institutions can reduce operational costs, increase service delivery speed, and enhance customer satisfaction. These solutions facilitate proactive risk management and regulatory compliance, empowering financial institutions to focus on innovation and customer-centric strategies.

Kognitos leverages ai to automate various banking operations, such as customer onboarding, transaction monitoring, and compliance auditing. By utilizing machine learning algorithms, the platform can identify patterns and anomalies in financial data, enabling banks to detect fraud and streamline operations. This automation reduces manual intervention, enhances data accuracy, and improves the overall efficiency of banking processes.

Implementing accounting automation with Kognitos offers several benefits, including reduced manual errors, faster processing of financial data, and increased accuracy in reporting. The platform automates complex tasks such as reconciliations, expense management, and financial close processes, enabling accountants to focus on strategic analysis and decision-making. This automation leads to enhanced financial transparency and more informed business strategies.

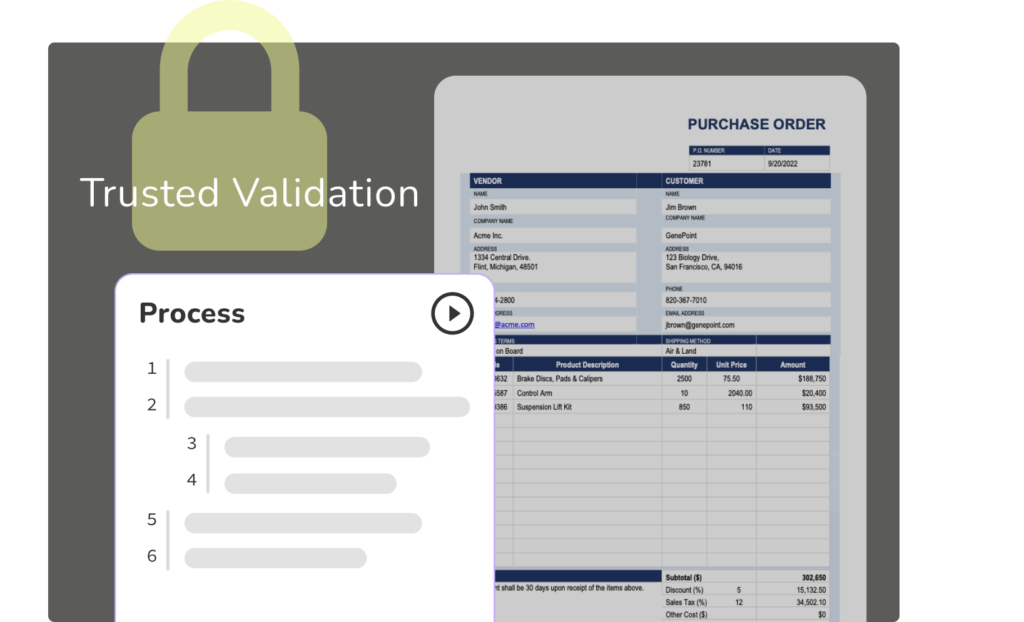

Kognitos facilitates real-time accounting process automation by integrating ai-driven tools that enable immediate data capture, validation, and reconciliation. The platform’s advanced technology ensures that financial statements are continuously updated and accurate, allowing businesses to access timely and relevant insights for decision-making. This automation reduces latency in financial reporting, improves data accuracy, and supports proactive financial management.